Standard Tax Deduction 2025 For Seniors State. $1,850 for single or head of household For the 2025 tax year (for forms you file in 2025), the.

The 2025 standard deduction for tax returns filed in 2025 is $14,600 for single filers, $29,200 for joint filers or $21,900 for heads of household.

A taxpayer born after 1946 who has reached the age of 67, is allowed a deduction against all income (including, but not limited to, retirement and pension income).

2025 Tax Brackets For Seniors Clovis Jackqueline, Married filing jointly or qualifying surviving spouse—$27,700. The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

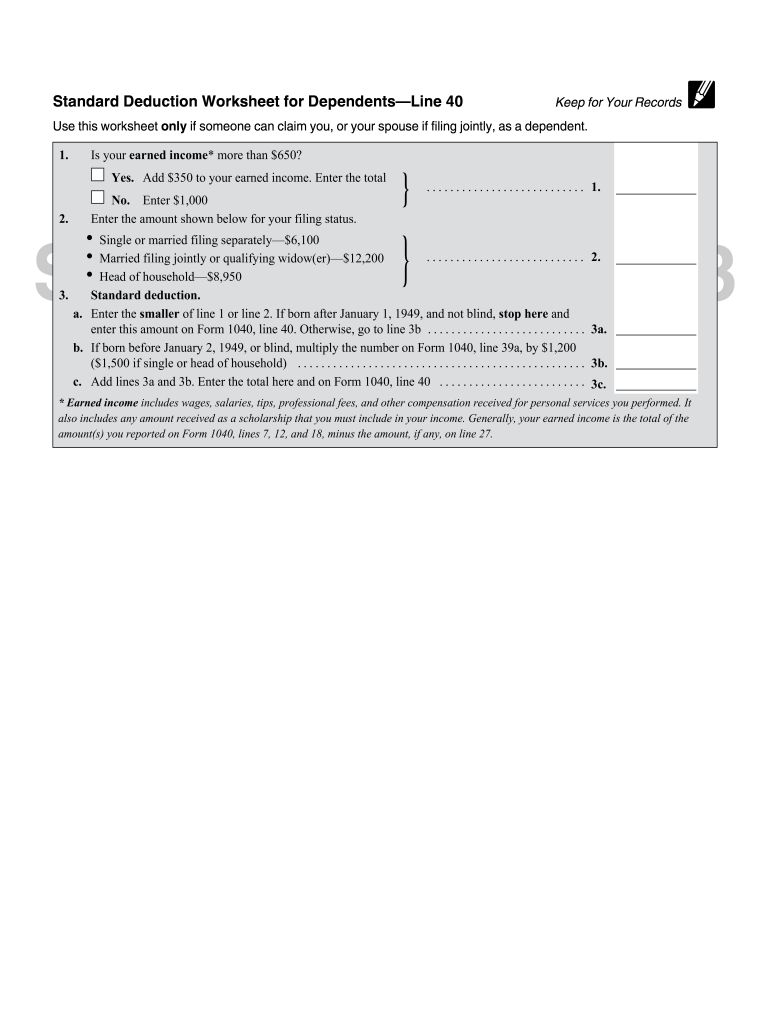

Federal Tax Brackets 2025 For Seniors Kirby Carilyn, The federal standard deduction for a single filer in 2025 is $ 14,600.00. In general, the standard deduction is adjusted each year for inflation and varies according to your filing status, whether you're 65 or older and/or blind, and whether another taxpayer can claim you as a dependent.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025; The additional standard deduction amount increases to.

Form 1040SR U.S. Tax Return for Seniors Definition and Filing, That rate of increase is higher. Anyone making less than $13,850 per year would have no taxable income and owe no state taxes.

:max_bytes(150000):strip_icc()/IRSForm1040-SR-cabde4390e1b4590b59cf978edb7675e.png)

Standard Tax Deductions for Retirees and Seniors Tax Relief Center, The additional standard deduction amount for 2025 is $1,550. Click here for assistance in calculating interest for tax paid on or after january 1, 2025.

2025 Tax Brackets And Deductions Cody Mercie, Expanded eligibility for deducting healthcare costs. Alternative minimum tax exemption increased.

Irs 2025 Standard Deductions And Tax Brackets Siana Maegan, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025; Individuals who cover health insurance premiums for their senior.

Tax Year 2025 Standard Deduction Over 65 Dina Myrtia, Enhanced relief programs for senior homeowners. $1,850 for single or head of household

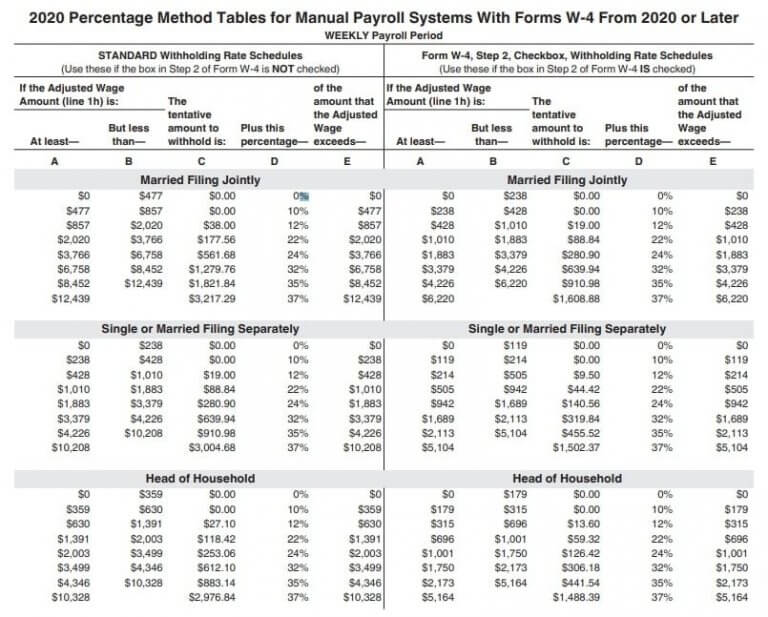

Standard deduction 2025 Fill out & sign online DocHub, Federal married (joint) filer tax tables. Section 63(c)(2) provides the standard deduction for use in filing individual income tax returns.

Standard Deduction 2025 Amounts Are Here YouTube, Taxpayers 65 and older and those who are blind can claim an additional standard deduction. People 65 or older may be eligible for a.

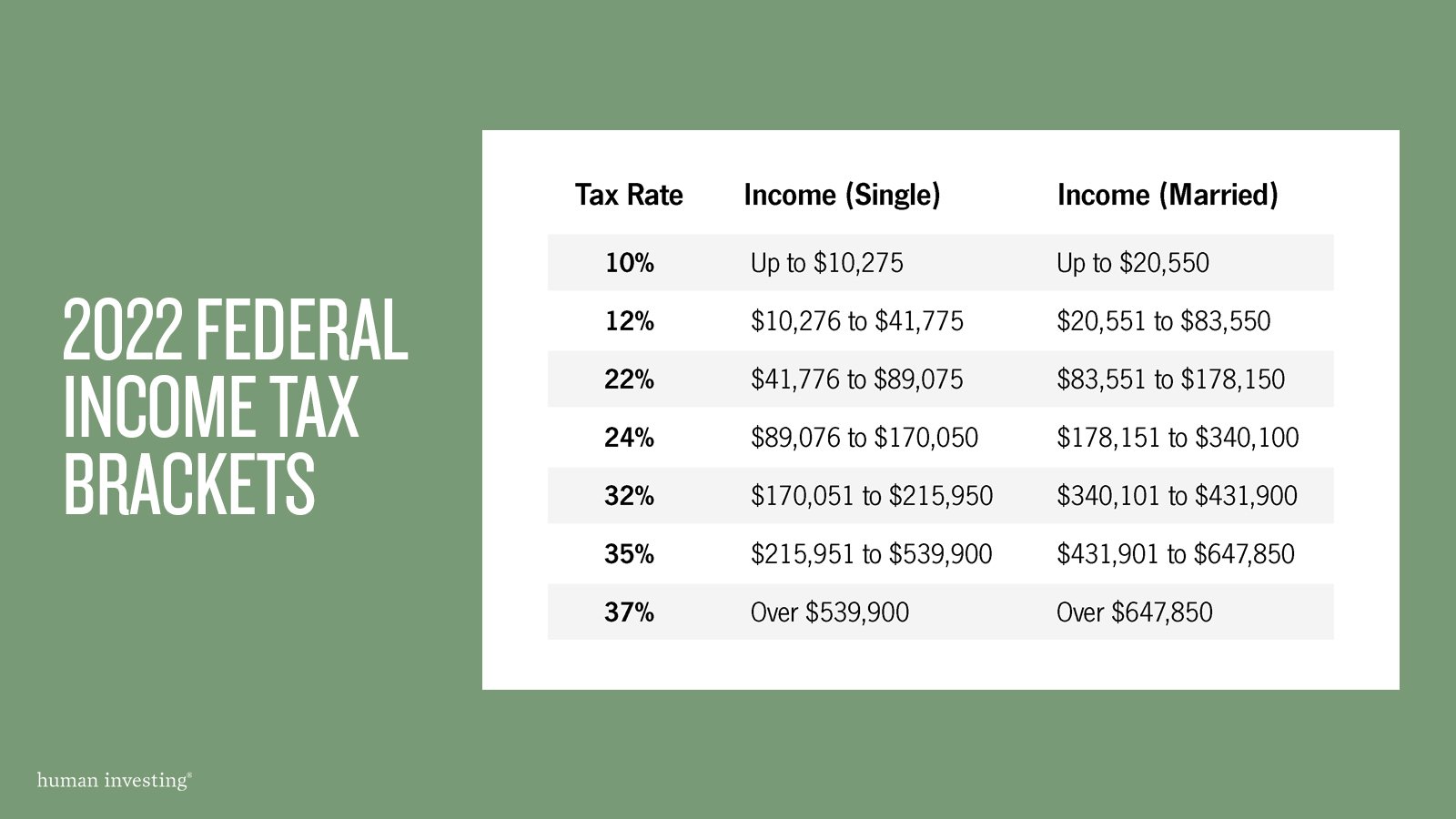

Tax year 2025 standard deduction over 65 dina myrtia, irs unveils new tax brackets, standard deduction for 2025 tax year, 10%, 12%, 22%, 24%, 32%, 35%, and 37%.