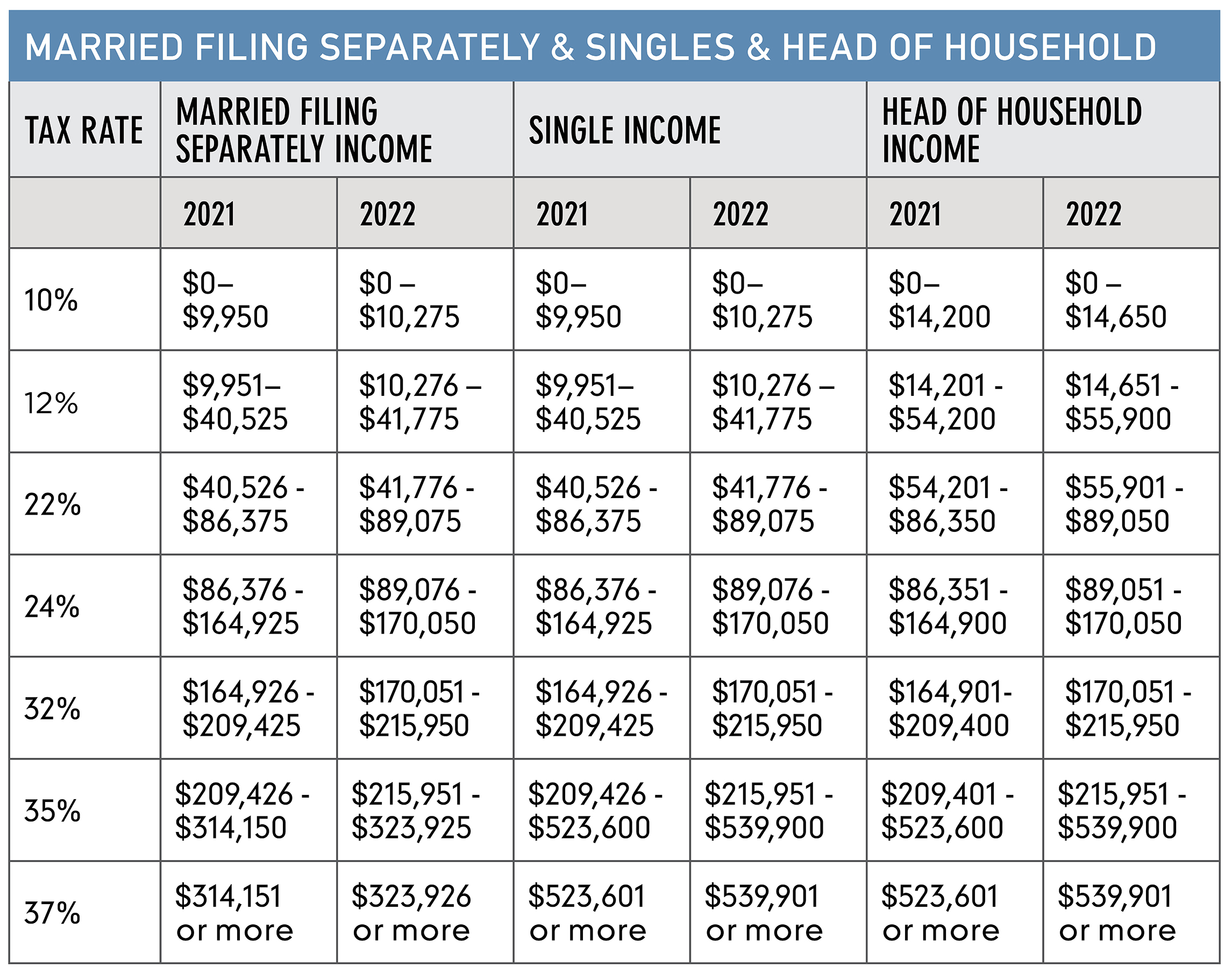

Married Filing Separately Tax Brackets 2025. The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Generally, as your income increases, you’ll.

Tax Bracket 2025 Married Filing Separately Single Keith Graham, 2025 tax bracket for those married filing jointly (and surviving spouses):

Tax Rates Heemer Klein & Company, PLLC, 2025 tax bracket for those married filing jointly (and surviving spouses):

Tax Brackets Definition, Types, How They Work, 2025 Rates, In 2025, the 28 percent amt rate applies to excess amti of $239,100 for all taxpayers ($119,550 for married couples filing separate returns).

Stern Kory Sreden & Tax Planning Guide 2025 Tax Planning, Calculate your personal tax rate based on your adjusted gross income for the 2025 tax year.

Tax Bracket 2025 Married Filing Separately Calculator Beckie Susana, In 2025, the excess taxable income above which the 28% tax rate applies will likely be $119,550 for married taxpayers filing separate returns and $239,100 for all other non.

Tax Brackets 2025 Married Separately Lark Devinne, For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises to $15,000 for 2025, an increase of $400 from 2025.

Tax Brackets 2025 Married Filing Jointly Standard Deduction Kaia Annnora, For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises to $15,000 for 2025, an increase of $400 from 2025.

Tax Brackets 2025 Married Filing Separately Darci Elonore, The standard deduction rises to $30,000, an increase of.

Married Filing Separately Tax Brackets 2025 Charis Myrlene, The new tax brackets for 2025 reflect the small inflation increase.

2025 Tax Brackets Married Filing Separately With Dependents Kathi Kendre, The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.